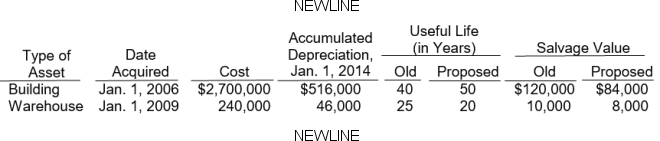

Mike Geary, the controller of Shellhammer Company, has reviewed the expected useful lives and salvage values of selected depreciable assets at the beginning of 2014. Here are his findings:

All assets are depreciated by the straight-line method. Shellhammer Company uses a calendar year in preparing annual financial statements. After discussion, management has agreed to accept Mike's proposed changes. (The "Proposed" useful life is total life, not remaining life.)

All assets are depreciated by the straight-line method. Shellhammer Company uses a calendar year in preparing annual financial statements. After discussion, management has agreed to accept Mike's proposed changes. (The "Proposed" useful life is total life, not remaining life.)

Instructions

(a) Compute the revised annual depreciation on each asset in 2014. (Show computations.)

(b) Prepare the entry (or entries) to record depreciation on the building in 2014.

Definitions:

Systematic Risk Principle

The concept that an investor can reduce the overall risk of an investment portfolio through diversification, except for inherent market risks that cannot be diversified away.

Efficient Markets Hypothesis

The efficient markets hypothesis is an investment theory that states it is impossible to "beat the market" because stock market efficiency causes existing share prices to always incorporate and reflect all relevant information.

Security Market Line

A representation in finance that shows the relationship between risk and return of a market.

Beta Coefficient

A measure of a stock's volatility in relation to the overall market, indicating its level of risk compared to the market average.

Q40: Jack's Copy Shop bought equipment for $150,000

Q83: Internal auditors<br>A) are hired by CPA firms

Q102: Use the following information regarding Black Company

Q237: In periods of inflation, phantom or paper

Q253: Inventory methods such as FIFO and LIFO

Q256: A $100 petty cash fund has cash

Q260: Stan's Lumber Mill sold two pieces of

Q284: Moon Company issued $500,000, 10%, 5-year bonds

Q291: A permanent decline in the market value

Q302: Bonds that are subject to retirement at