On January 1, 2012, Keller Company purchased and installed a telephone system at a cost of $20,000. The equipment was expected to last five years with a salvage value of $3,000. On January 1, 2013, more telephone equipment was purchased to tie-in with the current system for $10,000. The new equipment is expected to have a useful life of four years. Through an error, the new equipment was debited to Utilities Expense. Keller Company uses the straight-line method of depreciation.

Instructions

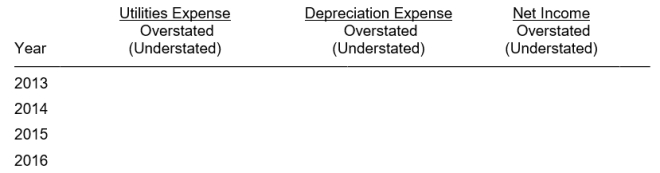

Prepare a schedule showing the effects of the error on Utilities Expense, Depreciation Expense, and Net Income for each year and in total beginning in 2013 through the useful life of the new equipment.

Definitions:

Competitive Advantage

A unique attribute or competency a company possesses that enables it to outperform its competitors, providing it with a market advantage.

Brand Loyalty

The tendency of consumers to continuously purchase one brand's products over competing ones due to their trust and satisfaction with the brand.

Rewards Program

A marketing strategy designed to encourage customer loyalty by offering incentives, such as points, gifts, or discounts, for frequent or sizable purchases.

Marketing Strategy

a company's plan designed to promote products or services to reach a specific target market, involving decisions on product, price, place, and promotion.

Q30: If bonds have been issued at a

Q58: Mark's Repair Service uses the straight-line method

Q92: Liabilities are classified on the balance sheet

Q115: Ace Company is a retailer operating in

Q116: Bonds with a face value of $400,000

Q125: Which one of the following items would

Q176: The effective-interest method of amortization of bond

Q182: An effective system of internal control centralizes

Q204: A petty cash fund is used to

Q224: The depreciation method that applies a constant