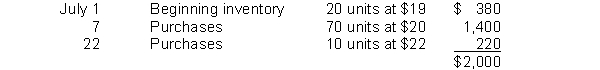

Radical Radials Company has the following inventory data:  A physical count of merchandise inventory on July 30 reveals that there are 32 units on hand. Using the LIFO inventory method, the amount allocated to ending inventory for July is

A physical count of merchandise inventory on July 30 reveals that there are 32 units on hand. Using the LIFO inventory method, the amount allocated to ending inventory for July is

Definitions:

Child and Dependent

Terms used in tax law to refer to individuals for whom the taxpayer provides more than half of financial support, qualifying the taxpayer for certain deductions.

Care Expense Credit

A tax credit available for expenses incurred in caring for a qualifying individual to allow the taxpayer to work or look for work.

AGI

Adjusted Gross Income, which is gross income minus adjustments; a key measure used to determine tax liabilities and eligibility for credits.

EIC

Earned Income Credit; a refundable tax credit in the U.S. for low to moderate-income working individuals and families, particularly those with children.

Q19: Presented below is the Trial Balance and

Q52: Plant assets are ordinarily presented in the

Q63: The responsibility for ordering, receiving, and paying

Q92: A check correctly written for $370 was

Q110: Identify which of the following reconciling items

Q160: The post-closing trial balance will contain only

Q174: Which of the following does not appear

Q237: Which of the following would not be

Q240: Goodwill<br>A) may be expensed upon purchase if

Q250: Cash is a temporary account.