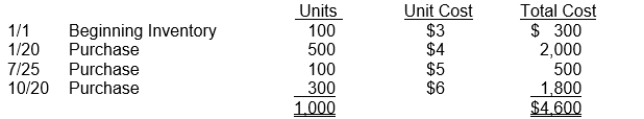

Hansen Company uses the periodic inventory method and had the following inventory information available:  A physical count of inventory on December 31 revealed that there were 380 units on hand.

A physical count of inventory on December 31 revealed that there were 380 units on hand.

Instructions

Answer the following independent questions and show computations supporting your answers.

1. Assume that the company uses the FIFO method. The value of the ending inventory at December 31 is $__________.

2. Assume that the company uses the average cost method. The value of the ending inventory on December 31 is $__________.

3. Assume that the company uses the LIFO method. The value of the ending inventory on December 31 is $__________.

4. Determine the difference in the amount of income that the company would have reported if it had used the FIFO method instead of the LIFO method. Would income have been greater or less?

Definitions:

Par Value

A nominal dollar amount assigned to corporate shares, representing the minimum price per share that shares can be issued at.

Stated Value

A value that has been assigned to a corporation's stock that does not have a par value, often used for accounting purposes.

Treasury Stock

Shares that were issued and later reacquired by the issuing corporation.

Additional Paid-In Capital

The excess amount paid by investors over the par value of shares during equity issuances, reflecting additional funding invested in the company.

Q33: What is the rationale for the internal

Q70: Samson Instruments is a rapidly growing manufacturer

Q84: In a perpetual inventory system,<br>A) LIFO cost

Q135: Dole Industries had the following inventory transactions

Q173: If a business pays rent in advance

Q222: Adjusting entries can be classified as:<br>A) postponements

Q223: In a small business, the lack of

Q241: Hogan Industries had the following inventory transactions

Q251: The use of prenumbered checks is an

Q272: A liability-revenue relationship exists with:<br>A) asset accounts.<br>B)