The Downtown Company accumulates the following adjustment data at December 31.

1. Revenue of $1,100 collected in advance has been recognized.

2. Salaries of $600 are unpaid.

3. Prepaid rent totaling $400 has expired.

4. Supplies of $550 have been used.

5. Revenue recognized but unbilled totals $750.

6. Utility expenses of $300 are unpaid.

7. Interest of $250 has accrued on a note payable.

Instructions:

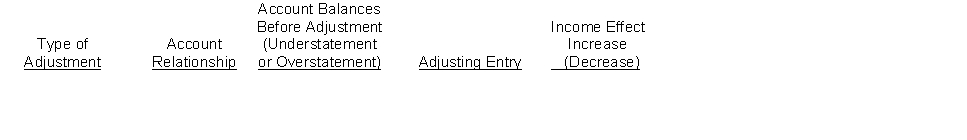

(a) For each of the above items indicate:

1. The type of adjustment (prepaid expense, unearned revenue, accrued revenue, or accrued expense).

2. The account relationship (asset/liability, liability/revenue, etc.).

3. The status of account balances before adjustment (understatement or overstatement).

4. The adjusting entry.

(b) Assume net income before the adjustments listed above was $22,500. What is the adjusted net income?

Prepare your answer in the tabular form presented below.

Definitions:

Analytic Notes

Notes an ethnographer writes as a way to make sense of or interpret the raw data or descriptive notes.

Ethnographer

A researcher who studies human cultures through immersion in the environment, observation, and interviews.

Raw Data

Data collected from experiments or surveys in its original, unprocessed form.

Theory

A set of principles or explanations that accounts for observed phenomena and predicts future events.

Q23: Many companies use just-in-time inventory methods. Which

Q27: A company may use more than one

Q31: The expense recognition principle matches:<br>A) customers with

Q37: The following information is available for Bradshaw

Q51: Use the following information for Boxter, Inc.,

Q71: Young Company lends Dobson industries $40,000 on

Q98: The monetary unit assumption has led to

Q110: The expense recognition principle relates to credit

Q180: Each of the following is a major

Q242: If the unit price of inventory is