A review of the ledger of Wilde Co. at December 31, 2014, produces the following data pertaining to the preparation of annual adjusting entries:

(a) Salaries and Wages Payable $0: Salaries are paid every Friday for the current week. Five employees receive a weekly salary of $800, and three employees earn a weekly salary of $700. December 31 is a Tuesday. Employees do not work weekends. All employees worked the last 2 days of December.

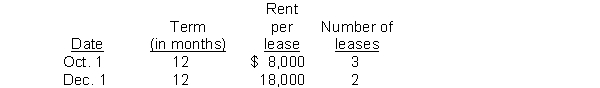

(b) Unearned Rent Revenue $58,000: The company had several lease contracts during the year as shown below:  (c) Notes Receivable $90,000: This is a 6-month note, dated November 1, 2014, with a 6% interest rate.

(c) Notes Receivable $90,000: This is a 6-month note, dated November 1, 2014, with a 6% interest rate.

Instructions:

Prepare the adjusting entries at December 31, 2014. Show all computations.

Definitions:

Clean Economy

An economy that produces goods and services with environmental benefit.

Chief Sustainability Officer

A corporate executive responsible for integrating and managing an organization’s sustainable practices, ensuring environmental, social, and economic viability.

Energy-efficiency

The goal or method of reducing the amount of energy required to provide products and services.

Ecologically Sustainable

Practices and processes that preserve environmental resources for future generations while meeting current needs.

Q14: Under the allowance method, when a year-end

Q39: Adjustments for accrued revenues:<br>A) increase assets and

Q50: Depreciation is an _ concept, not a

Q83: When the allowance method is used to

Q90: Ratios that measure the income or operating

Q166: Wilton Corporation had beginning retained earnings of

Q178: The two fundamental qualities of useful information

Q264: The policy at Adler Corporation is to

Q301: Accumulated Depreciation is a liability account and

Q309: Accrued revenues are:<br>A) received and recorded as