The Downtown Company accumulates the following adjustment data at December 31.

1. Revenue of $1,100 collected in advance has been recognized.

2. Salaries of $600 are unpaid.

3. Prepaid rent totaling $400 has expired.

4. Supplies of $550 have been used.

5. Revenue recognized but unbilled totals $750.

6. Utility expenses of $300 are unpaid.

7. Interest of $250 has accrued on a note payable.

Instructions:

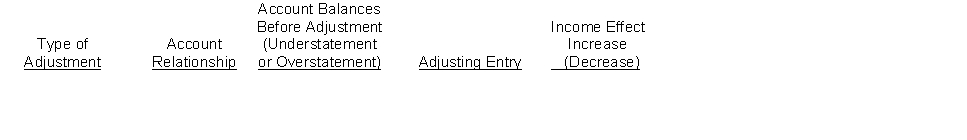

(a) For each of the above items indicate:

1. The type of adjustment (prepaid expense, unearned revenue, accrued revenue, or accrued expense).

2. The account relationship (asset/liability, liability/revenue, etc.).

3. The status of account balances before adjustment (understatement or overstatement).

4. The adjusting entry.

(b) Assume net income before the adjustments listed above was $22,500. What is the adjusted net income?

Prepare your answer in the tabular form presented below.

Definitions:

Fixed-Ratio

In the context of reinforcement learning, it describes a schedule where a response is reinforced only after a specified number of responses have occurred, leading to a high, steady rate of responding.

Variable-Ratio

A reinforcement schedule in which the number of responses required for a reward varies around an average, making the reinforcement unpredictable and typically leading to high and stable response rates.

DRH

A differential reinforcement of high rates of behavior schedule where reinforcement is contingent on responses being made at or above a certain rate.

DRO

A behavioral intervention technique known as Differential Reinforcement of Other behavior, where reinforcement is delivered for any behavior other than a target behavior.

Q16: Three accounting issues associated with accounts receivable

Q59: Great Plains Supply Co. has the following

Q91: Orange-Aide Company has the following inventory data:

Q169: The periodicity assumption states that the business

Q178: Trent Distributors has the following transactions related

Q209: Schmidt Company received a letter from Deborah

Q215: Greese Company purchased office supplies costing $4,000

Q238: Declaring a cash dividend will<br>A) increase retained

Q294: On April 1, 2013, nPropel Corporation paid

Q307: The _ assumption states that the economic