A review of the ledger of Wilde Co. at December 31, 2014, produces the following data pertaining to the preparation of annual adjusting entries:

(a) Salaries and Wages Payable $0: Salaries are paid every Friday for the current week. Five employees receive a weekly salary of $800, and three employees earn a weekly salary of $700. December 31 is a Tuesday. Employees do not work weekends. All employees worked the last 2 days of December.

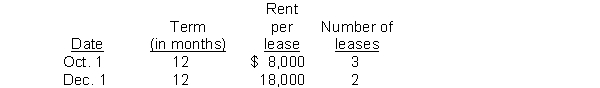

(b) Unearned Rent Revenue $58,000: The company had several lease contracts during the year as shown below:  (c) Notes Receivable $90,000: This is a 6-month note, dated November 1, 2014, with a 6% interest rate.

(c) Notes Receivable $90,000: This is a 6-month note, dated November 1, 2014, with a 6% interest rate.

Instructions:

Prepare the adjusting entries at December 31, 2014. Show all computations.

Definitions:

Monitoring

The process of observing and tracking certain activities, behaviors, or information to gather insights or maintain control.

KPI

Key Performance Indicator, a measurable value that demonstrates how effectively a company is achieving key business objectives.

Expensive

Involving a high cost or requiring a significant outlay of money.

Metrics

Quantitative measures used to assess, compare, and track performance or progress, often used within the context of business, marketing, and social media.

Q45: An error in the physical count of

Q151: The economic entity assumption states that assets

Q169: Leyland Realty Company received a check for

Q173: The most generally accepted value used in

Q194: One might infer from a debit balance

Q209: Carter Company reported these income statement data

Q215: The debt to assets ratio is computed

Q218: Which of the following is a constraint

Q252: The accountant at Patton Company has determined

Q286: An adjusted trial balance must be prepared