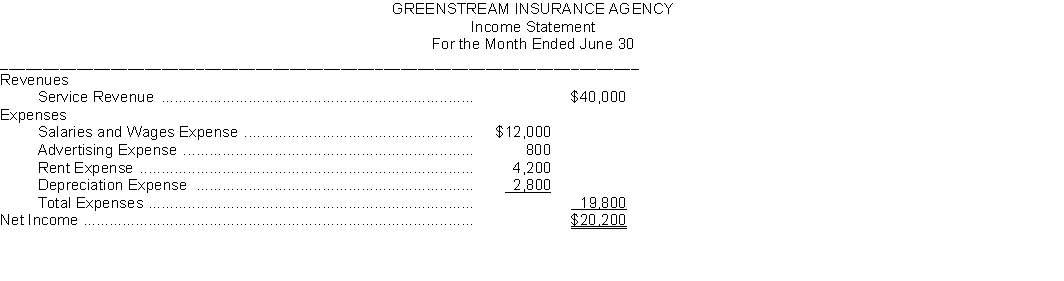

Greenstream Insurance Agency prepares monthly financial statements. Presented below is an income statement for the month of June that is correct on the basis of information considered.  Additional Data: When the income statement was prepared, the company accountant neglected to take into consideration the following information:

Additional Data: When the income statement was prepared, the company accountant neglected to take into consideration the following information:

1. A utility bill for $1,200 was received on the last day of the month for electric and gas service for the month of June.

2. A company insurance salesman sold a life insurance policy to a client for a premium of $10,000. The agency billed the client for the policy and is entitled to a commission of 20%.

3. Supplies on hand at the beginning of the month were $2,500. The agency purchased additional supplies during the month for $1,500 in cash and $1,200 of supplies were on hand at June 30.

4. The agency purchased a new car at the beginning of the month for $24,000 cash. The car will depreciate $6,000 per year.

5. Salaries owed to employees at the end of the month total $5,300. The salaries will be paid on July 5.

Instructions:

Prepare a corrected income statement.

Definitions:

Accrued Revenues

Assets (receivables) created when revenues are earned, but cash will be collected from customers in the future; created at end of period during the adjustment process to reflect the amount of revenue earned by providing goods or services over time to customers who will pay in the future.

Stockholders' Equity

The residual interest in the assets of a corporation after deducting its liabilities, representing the owners' claim on the company assets.

Assets

Resources owned by a company from which future economic benefits are expected to flow to the company.

Deferred Expenses

Assets created when purchased in the past before being used to generate revenues; need to be adjusted at the end of the period to reflect the amount of expense incurred by using the assets over time.

Q1: Your friend Mark has opened an office

Q67: The revenue recognition principle dictates that revenue

Q108: Earnings per share measures the net income

Q139: The face value of a note refers

Q149: An adjusted trial balance:<br>A) is prepared after

Q187: Cost constraint weighs the cost that companies

Q194: River Ridge Music School borrowed $30,000 from

Q230: Ace Company is a retailer operating in

Q267: Unearned revenue is classified as a(n):<br>A) asset

Q268: Karcan, Inc. purchased supplies costing ₤2,500 on