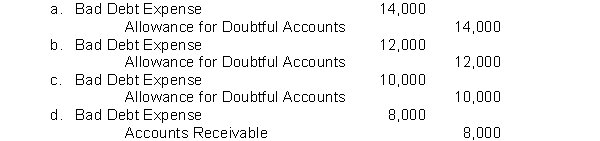

Kinsler Company uses the percentage-of-receivables method for recording bad debt expense. The Accounts Receivable balance is $200,000 and credit sales are $1,000,000. Management estimates that 6% of accounts receivable will be uncollectible. What adjusting entry will Kinsler Company make if the Allowance for Doubtful Accounts has a credit balance of $2,000 before adjustment?

Definitions:

Students

Individuals who are engaged in learning, especially those who attend an educational institution.

Maximum Profit

The greatest difference between revenue and expense.

Quadratic Function

A polynomial function of the second degree, generally represented as f(x) = ax^2 + bx + c, where a, b, and c are constants and a ≠ 0.

Factoring

A financial transaction where a business sells its accounts receivable to a third party at a discount to gain immediate cash.

Q16: Free cash flow represents<br>A) cash provided by

Q37: Given the following adjusted trial balance, what

Q63: The percentage of receivables approach to estimating

Q69: Profitability means having enough funds on hand

Q94: When a note is dishonored, the payee's

Q110: Net income is recorded on the worksheet

Q112: The following is selected information from C

Q123: Thompson Corporation's unadjusted trial balance includes

Q148: In 2014 Grider Corporation had cash receipts

Q194: One might infer from a debit balance