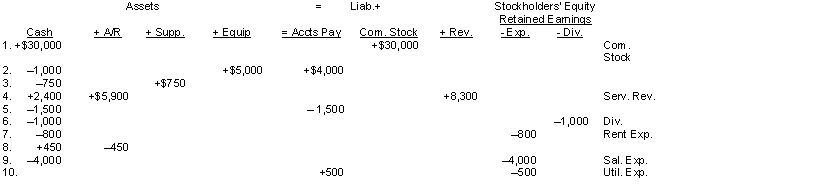

A tabular analysis of the transactions made during August 2014 by Baxter Company during its first month of operations is shown below. Each increase and decrease in stockholders' equity is explained.  Instructions

Instructions

(a) Determine how much stockholders' equity increased for the month.

(b) Compute the net income for the month.

Definitions:

Desert Crusts

Biological crusts formed by a community of microorganisms, including cyanobacteria, algae, and fungi, which stabilize desert soils and prevent erosion.

Nitrogen Fixation

Incorporation of nitrogen gas into ammonia.

Western Coast

The land along the western edge of a continent, facing the ocean or sea.

Chaparrals

A biome characterized by dense, spiny shrubs and a Mediterranean climate, with hot, dry summers and cool, wet winters, found in regions like California.

Q38: The purchase of an asset for cash<br>A)

Q42: If a company issues common stock for

Q71: The following items are taken from

Q93: If the assets owned by a business

Q102: McComb Inc. earns $900,000 and pays cash

Q143: Salaries and wages payable is a type

Q168: Which of the following is a measure

Q204: The proprietorship form of business organization<br>A) must

Q288: If the cost method is used to

Q297: The purchase of a company that is