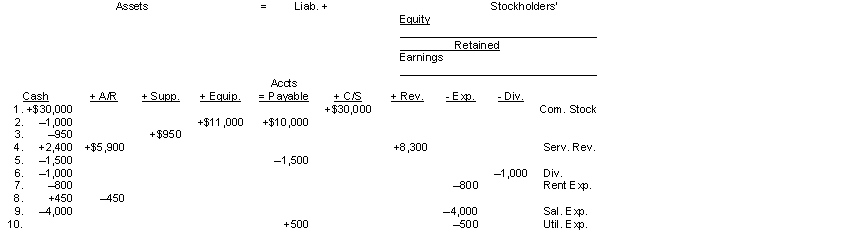

The tabular analysis of transactions for Baxter Company is presented below.  Instructions

Instructions

Prepare a retained earnings statement for August and a classified balance sheet at August 31, 2014.

Definitions:

Gross Pay

The total amount earned by an employee before any deductions or taxes are applied.

FICA-OASDI

Federal Insurance Contributions Act - Old Age, Survivors, and Disability Insurance, a U.S. payroll tax to fund Social Security.

State Unemployment Tax

A tax imposed by state governments on employers to fund unemployment insurance benefits for workers who lose their jobs.

Rate of Pay

The fixed amount of compensation an employee receives for their services, typically expressed on an hourly, daily, or per-task basis.

Q1: Which of the following is not a

Q126: Assume that Oslo Corp. acquires 30% of

Q145: Two primary external users of accounting information

Q148: Notes to the financial statements include all

Q149: The retained earnings statement is more comprehensive

Q177: Which of the following is a debt

Q199: Which of the following is not one

Q220: For information to be useful, it must

Q229: Under IFRS<br>A) comparative prior-period information must be

Q268: Which pair of the listed accounts follows