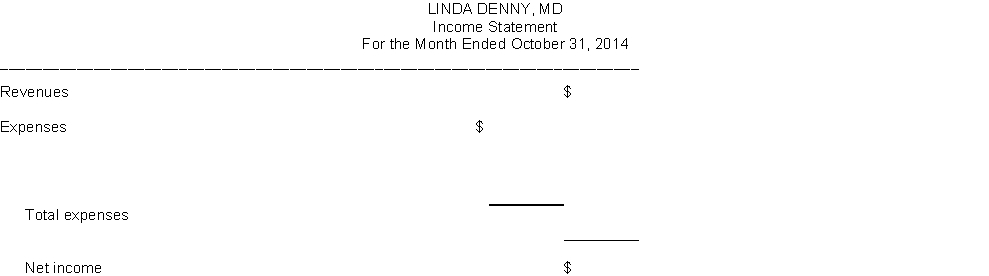

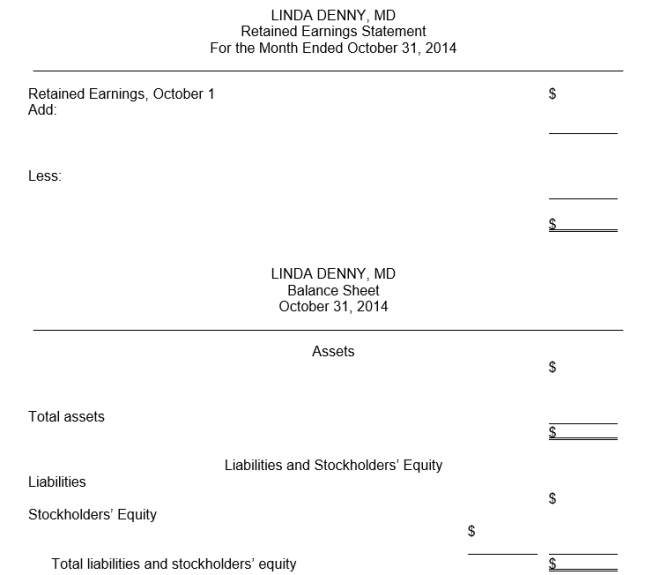

Prepare an income statement and a retained earnings statement, for the month of October, 2014 and a balance sheet at October 31, 2014 for the medical practice of Linda Denny, MD, from the items listed below.

Definitions:

Special Order

A special order refers to a one-time order that is outside the scope of regular production or services, often requiring a unique pricing and decision-making process.

Annual Financial Advantage

The financial benefits or savings realized by a company over the course of a year, often resulting from efficiencies, investments, or strategic decisions.

Outside Supplier

A third-party company that provides goods or services to another company, as opposed to the company producing these items in-house.

Purchase Subcomponent

The act of buying parts or elements that will be used to assemble a final product.

Q4: If expenses are paid in cash, then<br>A)

Q9: Net income for the period is determined

Q9: Because social entrepreneurial ventures serve social ends

Q13: A summative evaluation is conducted following completion

Q59: A trial balance will not balance if<br>A)

Q92: A journal<br>A) contains only asset and liability

Q123: Customarily, a trial balance is prepared<br>A) at

Q168: Which pair of the listed accounts follows

Q202: The _ of an annuity is the

Q231: Equipment costing $20,000 is purchased by paying