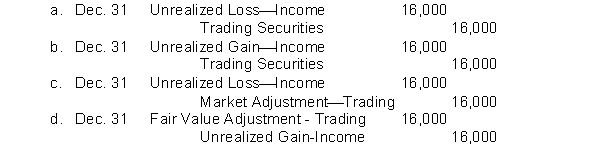

Cost and fair value data for the trading securities of Beltway Company at December 31, 2014, are $100,000 and $84,000, respectively. Which of the following correctly presents the adjusting journal entry to record the securities at fair value?

Definitions:

Fixed Manufacturing Overhead

The portion of manufacturing costs that do not vary with the level of production, such as salaries of supervisors and rent for factory buildings.

Variable Costing

A costing method that includes only variable production costs in the cost of goods sold, excluding fixed manufacturing overhead.

Absorption Costing

A method of product costing that captures all costs associated with manufacturing a product, including overhead expenses.

Variable Production Costs

Variable production costs fluctuate with the level of production output and include expenses like raw materials and labor directly tied to the production process.

Q10: Deutsche Corporation's trading portfolio at the end

Q19: Debts and obligations of a business are

Q33: Which of the following is NOT one

Q43: Why should you approach business angels? What

Q53: The purpose of the ledger is to<br>A)

Q85: If the single amount of $5,000 is

Q103: Some of the following errors would cause

Q169: A stock investment classified as trading securities

Q211: Which of the following groups uses accounting

Q238: All of the following are necessary to