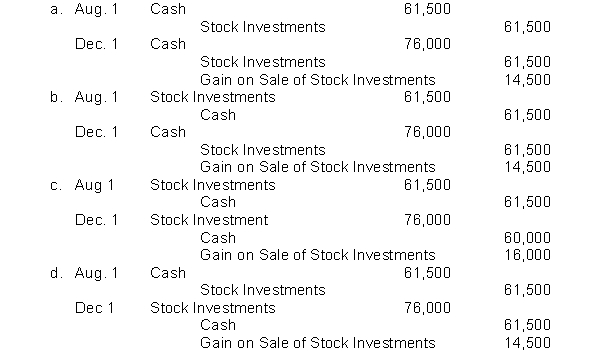

On August 1, Basil Company buys 2,000 shares of Zingo common stock for $61,500 cash. On December 1, the stock investments are sold for $76,000 in cash. Which of the following are the correct journal entries of record for the purchase and sale of the common stock?

Definitions:

Bonus Pay

Additional compensation given to employees as a reward for achieving specific goals, performance levels, or for exceptional work beyond their regular pay.

Merit Pay

A system of compensation where employees are awarded pay increases or bonuses based on their performance or achievements.

Profit-Sharing

A compensation strategy where employees receive a share of the company's profits, typically as a supplement to their regular income.

Lump-Sum Payments

A single payment made at a particular time, as opposed to multiple payments made over a period of time.

Q2: Compound interest is the return on principal<br>A)

Q20: Which of the following is not suitable

Q23: How might a social entrepreneur be different

Q46: Pledging means using accounts payable as collateral

Q49: What is the maximum dollar amount of

Q53: The most critical first task in transitioning

Q54: Entrepreneurs requiring initial startup funding, generally seek

Q102: McComb Inc. earns $900,000 and pays cash

Q160: Which of the following is an asset?<br>A)

Q180: Debits<br>A) increase both assets and liabilities.<br>B) decrease