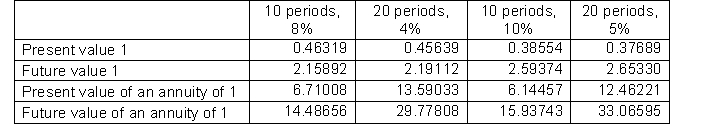

Patterson Company is about to issue $8,000,000 of 10-year bonds paying an 8% interest rate with interest payable semiannually. The discount rate for such securities is 10%. Below are time value of money factors that Patterson uses to calculate compounded interest.  To the closest dollar, how much can Patterson expect to receive for the sale of these bonds?

To the closest dollar, how much can Patterson expect to receive for the sale of these bonds?

Definitions:

Sociology

The scientific study of society, social relationships, social interactions, and culture that surrounds everyday life.

Diverse Society

A community characterized by a variety of different cultural, ethnic, racial, and social backgrounds.

Capitalism

An economic system based on private ownership and the free market, characterized by the pursuit of profit.

Lumpenproletariat

A term coined by Marx to describe the class of outcasts in society, such as the unemployed and criminals, who are not involved in industrial production.

Q6: Many noncash transactions are represented in the

Q27: S corporations have the same restrictions as

Q31: Which of the following is not a

Q41: This information is for Campo Corporation

Q46: Pledging means using accounts payable as collateral

Q53: The number of workers you draw from

Q56: Why might different countries have different needs

Q125: The right to receive money in the

Q196: If total liabilities decreased by $50,000 and

Q213: The financial statement that summarizes the changes