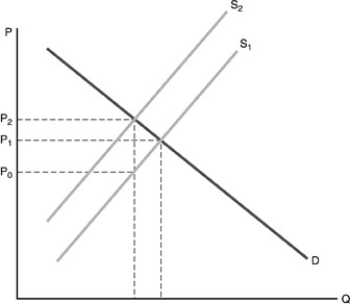

-Refer to the above figure. A unit tax has been placed on the good. The producer pays what amount of the tax?

Definitions:

Marginal Utility

The additional satisfaction or benefit received by a consumer from consuming one more unit of a good or service.

Consumer Surplus

Consumer surplus is the difference between the total amount that consumers are willing and able to pay for a good or service and the total amount that they actually pay.

Consumer Surplus

The difference between the total amount consumers are willing and able to pay for a good or service versus the total amount they actually pay.

Marginal Utility

The increased gratification or value a shopper obtains by buying one more of a certain item or service.

Q7: Which of the following is the cheapest

Q10: Dynamic tax analysis assumes<br>A)all of the present

Q24: Which of the following is an example

Q33: Which of the following forms of taxation

Q44: Suppose the tax rate on the first

Q45: How can one best predict the acceptance

Q47: What was the primary objective of the

Q55: A friend of yours receives a government

Q59: A good example of entrepreneurial frugality is:<br>A)Providing

Q119: If demand increases while supply decreases, then