-An excise tax is a tax that is levied on

Definitions:

Risk/Reward Tolerance

An individual's or entity’s capacity to assume risk with the expectation of receiving a corresponding return, balancing between potential gains and losses.

Venture Opportunities

Potential business concepts or markets that offer the chance for financial returns through the creation or expansion of enterprises.

Personal Criterion

An individual standard or principle used to judge or decide something.

Opportunity

A set of circumstances that makes it possible to do something or for something to happen, often leading to potential benefits.

Q11: Yahoo! Inc.'s IPO set the all-time record,

Q13: According to the GEM model, how many

Q16: How much does the Bayh-Dole Act contribute

Q18: A tax system in which the average

Q78: What was the effect of the Bayh-Dole

Q86: Private goods are goods<br>A)that carry a price.<br>B)for

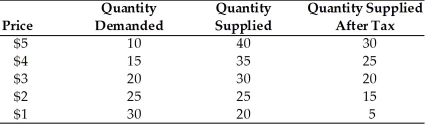

Q191: The government imposes a unit excise tax

Q234: Providing public goods is a(n)<br>A)economic function of

Q334: The provision of a legal system is

Q347: If the production of a product results