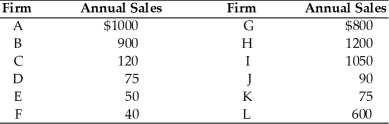

-According to the above table, the four-firm concentration ratio of this industry is

Definitions:

Tax Incidence

Tax Incidence refers to the analysis of the effect of a particular tax on the distribution of economic welfare, showing which group – consumers or producers – ultimately bears the burden of the tax.

Inelastic Supply

Describes a situation where the quantity supplied of a good or service is relatively unresponsive to changes in its price.

Consumers Of Food

Individuals or entities that ingest food products for nourishment and energy.

Excise Tax

A tax imposed on specific goods, such as tobacco and alcohol, typically gauged per unit.

Q1: The greater the product differentiation between monopolistically

Q33: If five firms of similar sizes join

Q33: Refer to the above figure. Regulators cannot

Q35: Monopolistic competition and perfect competition are similar

Q57: The model of perfect competition and the

Q80: Which of the following is NOT an

Q211: The college textbooks market is an example

Q236: All of the following are characteristics of

Q244: In the above figure for a monopolistically

Q283: The demand for the product of a