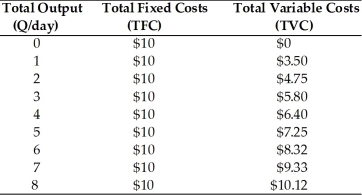

Notice the costs of production for a firm in the table below. What are the total costs for outputs of 7 units and 8 units respectively?

Definitions:

Corporate Income Tax

A tax imposed on the net income of corporations, calculated after allowable deductions and credits.

Federal Personal Income Tax

A tax levied by the federal government on the annual income of individuals.

Federal Tax Revenue

The financial income generated by the government through taxation, which includes individual income taxes, corporate taxes, and other taxes.

Individual Income Taxes

Taxes levied by a government on the income earned by individuals or households within their jurisdiction.

Q61: Accounting profits are typically<br>A)greater than economic profits

Q95: Average fixed costs will<br>A)rise as output rises.<br>B)fall

Q123: If an industry's long-run per-unit costs are

Q138: An industry in which an increase in

Q170: In the above figure, what is the

Q199: A company finds that at the output

Q246: The short-run break-even price is the point

Q264: In the above figure, if the firm

Q302: Accounting profit will always be<br>A)more than economic

Q347: The total cost of the firm<br>A)includes explicit