Use the following information for the next 5 questions.

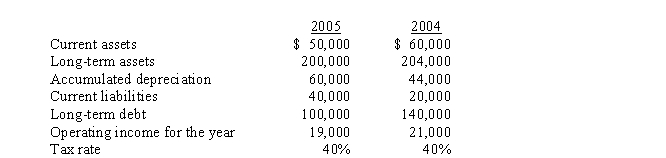

Bellingham Division has a required rate of return by corporate headquarters of 20%. The weighted average cost of capital is 12%. You are given the following information for Bellingham's operations for a two-year period:

-The residual income for 2005 was

Definitions:

Unprofitable Segment

A division or part of a company that does not generate profit and may result in a financial loss for the company.

Cost of Capital

The required return necessary to make a capital budgeting project, such as building a new factory or investing in new equipment, worthwhile.

Equity Funds

Investment funds that primarily invest in stocks, aiming to provide investors with growth or income through dividends and capital gains.

Borrowed Funds

Money that an entity obtains from another party with the promise to return the principal amount along with interest.

Q3: Unlikely as it may seem, which nursing

Q5: The best fetal tissue comes from fetuses

Q12: Which role of an informatics nurse involves

Q12: Calculating variances is a necessary, but not

Q23: Balanced scorecards can improve communication and consensus

Q52: Throughput costing is a modified form of<br>A)

Q54: (Appendix 12A) Depreciation tax savings are I.

Q71: To establish a cost-based price, managers need

Q85: Relevant cash flows for long-term decisions include

Q107: A corporate accounting department would most often