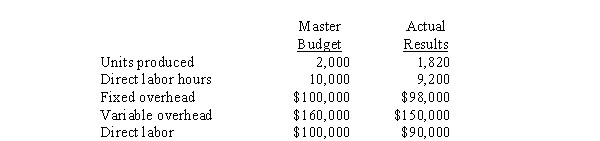

Use the following information for the next 6 questions.

Hyteck, Inc. is a capital intensive firm. Indirect costs make up nearly 70% of the product costs. The company has no direct material costs because customers provide the direct materials used for each job. To plan and control such costs, the firm employs flexible budgets and standard costs. Overhead rates, based on direct labor hours, are derived from the master budget.

-The budget variance for variable overhead was

Definitions:

Equilibrium

In economics and finance, a state where supply equals demand, and market forces are in balance, resulting in stable prices.

WEBS Portfolios

WEBS Portfolios, originally known as World Equity Benchmark Shares, are exchange-traded funds that track international stock market indexes.

Passively Managed

An investment strategy that involves mimicking the performance of a market index, typically resulting in lower fees and turnover rates compared to active management.

Brokerage Commissions

Brokerage commissions are fees charged by a broker for executing transactions or providing specialized services.

Q3: Lean accounting is accounting for organizations that

Q21: The capital investment was<br>A) $1,250,000<br>B) $75,000<br>C) $170,000<br>D)

Q22: To make the most profitable sell-or-process-further decisions,

Q44: Which of the following performance measures can

Q49: If the firm allocates joint costs to

Q63: The over- or underapplied overhead was<br>A) $50,000

Q82: Specific knowledge is I. More detailed than

Q90: In capital budgeting decisions, depreciation shields part

Q90: If J-M uses the physical output method

Q125: Normal fluctuations in labor hours may cause