Use the following information for the next 3 questions.

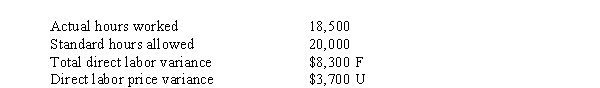

Dem Mfg. has gathered the following data in preparing to record their direct labor payroll costs for the week:

-The actual direct labor costs were

Definitions:

Rewards

are benefits, prizes, or other incentives given to individuals as recognition for their performance, behavior, or contribution, often used to motivate or encourage desired actions.

Relational De-Escalation

The process of reducing the intensity or closeness in an interpersonal relationship deliberately.

Communication Behaviors

The various ways in which individuals express themselves and interact with others through language and actions.

Dialectical Theory

A framework suggesting that relationships are dynamic and constantly changing, influenced by opposing tensions and contradictions.

Q13: How much would be charged to department

Q16: Which of the following formulas calculates price

Q31: For a particular investment project, the present

Q55: If HGT allocates joint costs using the

Q86: (Appendix 11A) The sales price variance is

Q95: Flexible budgets reflect I. Operations for actual

Q106: When reconciling from variable costing income to

Q129: The cost of ending finished goods inventory

Q131: Under what circumstances is penetration pricing considered

Q141: The net change in cash for the