Use the following information for the next 4 questions.

(CPA) The Dilly Company marks up all merchandise at 25% of gross purchase price. All purchases are made on account with terms of 1/10, (1% discount if paid in 10 days) net/60 (full amount due within 60 days) . Purchase discounts, which are recorded as miscellaneous income, are always taken. Normally, 60% of each month's purchases are paid for in the first month after purchase, whereas the other 40% are paid during the first 10 days of the first month after purchase. Inventories of merchandise at the end of each month are kept at 30% of the next month's forecasted cost of good sold.

Terms for sales on account are 2/10 (2% discount if paid within 10 days) , net/30 (full amount due in 30 days) . Cash sales are not subject to discount. Fifty percent of each month's sales on account are collected during the month of sale, 45% are collected in the succeeding month, and the remainder is usually uncollectible. Seventy percent of the collections in the month of sale are subject to discount, and 10% of the collections in the succeeding month are subject to discount (2%) .

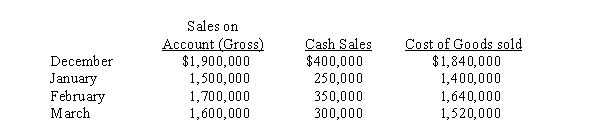

Forecasted sales data and cost of sales for selected months are as follows:

-Forecasted ending inventory for the month of December is

Definitions:

Work Expected

The anticipated amount of work or output that is expected from a process, project, or employee within a given timeframe.

Employee

An individual who works part-time or full-time under a contract of employment, providing labor to an employer in return for wages or salary.

Management Functions

Activities such as planning, organizing, leading, and controlling that are performed by management to efficiently and effectively coordinate the work of an organization.

Planning

The process of making plans for something, including setting goals and determining the means to achieve them.

Q5: Qualitative factors often influence strategic investment decisions.

Q8: When an organization implements activity-based budgeting, managers

Q9: How can ABC information be used to

Q13: What is the per-unit joint cost allocated

Q37: If a variance is unfavorable, it should

Q54: (Appendix 12A) Depreciation tax savings are I.

Q65: Which product(s) should be processed beyond the

Q106: Suppose that a company adds material at

Q120: Which of the following statements about life

Q127: Rebekah is an accountant for CHC Corporation.