Use the following information for the next 4 questions.

(CPA) The Dilly Company marks up all merchandise at 25% of gross purchase price. All purchases are made on account with terms of 1/10, (1% discount if paid in 10 days) net/60 (full amount due within 60 days) . Purchase discounts, which are recorded as miscellaneous income, are always taken. Normally, 60% of each month's purchases are paid for in the first month after purchase, whereas the other 40% are paid during the first 10 days of the first month after purchase. Inventories of merchandise at the end of each month are kept at 30% of the next month's forecasted cost of good sold.

Terms for sales on account are 2/10 (2% discount if paid within 10 days) , net/30 (full amount due in 30 days) . Cash sales are not subject to discount. Fifty percent of each month's sales on account are collected during the month of sale, 45% are collected in the succeeding month, and the remainder is usually uncollectible. Seventy percent of the collections in the month of sale are subject to discount, and 10% of the collections in the succeeding month are subject to discount (2%) .

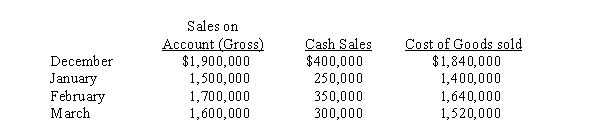

Forecasted sales data and cost of sales for selected months are as follows:

-Forecasted total collections from customers during February are

Definitions:

Insomnia

A sleep disorder characterized by difficulty falling and/or staying asleep.

Sleep Apnoea

A sleep disorder characterized by pauses in breathing or periods of shallow breathing during sleep.

Somnambulism

A sleep disorder in which people walk or perform other activities while they are still asleep; commonly known as sleepwalking.

Insomnia

A sleep disorder characterized by difficulty falling asleep, staying asleep, or obtaining restorative sleep, leading to daytime impairment.

Q3: Which of the following is a disadvantage

Q14: One objective of budgeting is motivating managers

Q14: Managers can improve the quality of information

Q28: The fixed overhead production volume variance was<br>A)

Q50: Which pricing method is used to capture

Q54: (Appendix 12A) Depreciation tax savings are I.

Q67: Different joint cost allocation methods cause products

Q78: LST Corporation entered into a new contract

Q82: (Appendix 12A) If nominal cash flow is

Q91: Which of the following statements is true?<br>A)