Use the following information for the next 3 questions.

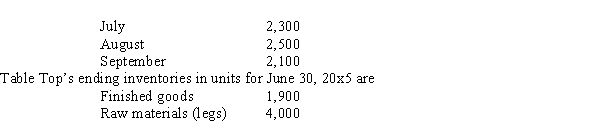

(CMA) Table Top produces tables sold to discount stores. The table tops are manufactured in the U.S. by Table Top, but the table legs are manufactured in a plant in Nogales, Mexico. The assembly department attaches the four purchased table legs to the table top. It takes 20 minutes of labor to assemble a table. The company follows a policy of producing enough tables to insure that 40% of next month's sales are in the finished goods inventory. Table Top also purchases sufficient raw materials to insure that raw materials inventory is 60% of the following month's scheduled production. Table Top's sales budget in units for the next quarter is as follows:

-The number of tables to be produced during August, 20x5 is

Definitions:

Fiscal Year

A fiscal year is a one-year period that companies and governments use for accounting purposes and preparing financial statements, which does not necessarily align with the calendar year.

Social Security Tax

Taxes collected to fund the Social Security program, providing benefits for retirement, disability, and survivors.

Personal Income Tax

A tax levied on individuals or households by the government based on their income, with rates typically increasing as income increases.

Federal Personal Income Tax Brackets

Federal Personal Income Tax Brackets are ranges of income taxed at specific rates within the federal tax system, designed to ensure tax is progressively imposed based on earners' ability to pay.

Q13: (Appendix 11A) The revenue sales quantity variance

Q61: Accountants normally can determine cost drivers for

Q64: What is the per-unit joint cost allocated

Q65: (Appendix 12A) The real rate of interest

Q66: Joint processes can result in I. Products<br>II.

Q74: (Appendix 11A) The contribution margin sales mix

Q93: When managers take advantage of an unusual

Q110: BVH Corporation manufactures and sells cellular phones.

Q113: Which of the following statements about costing

Q115: Support department costs are always allocated to