Use the following information for the next 3 questions.

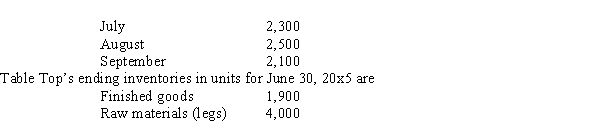

(CMA) Table Top produces tables sold to discount stores. The table tops are manufactured in the U.S. by Table Top, but the table legs are manufactured in a plant in Nogales, Mexico. The assembly department attaches the four purchased table legs to the table top. It takes 20 minutes of labor to assemble a table. The company follows a policy of producing enough tables to insure that 40% of next month's sales are in the finished goods inventory. Table Top also purchases sufficient raw materials to insure that raw materials inventory is 60% of the following month's scheduled production. Table Top's sales budget in units for the next quarter is as follows:

-Assume the required production for August and September is 1,600 and 1,800 units, respectively, and the July 31, 20x5 raw materials inventory is 4,200 units. The number of table legs to be purchased in August is

Definitions:

Annual Overhead Costs

The total expenses not directly tied to a product or service's production, incurred over a year, such as rent, utilities, and insurance.

Activity Base

A measure used in cost accounting to assign costs to various activities, often driving the allocation of overhead.

Overhead Application

The process of allocating indirect costs to specific cost objects, such as products or departments.

Q1: The managers of HRY Corporation are analyzing

Q10: The sales value at split-off point method

Q15: When managers use dual-rate allocation, they separate

Q17: Joint costs are allocated to individual products

Q66: Which is an advantage of an ABC

Q78: ABC systems are typically associated with<br>A) Higher

Q94: Apex Co. has $100,000 available for long-term

Q98: (CMA) If Ithica Manufacturing decides not to

Q98: When separable costs are deducted from the

Q117: Lookin' for a Home is an animal