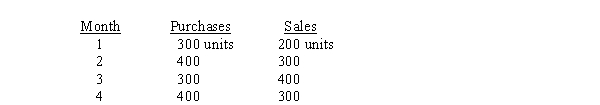

Use the following information for the next 2 questions.

Bynsel, Inc., a retailer, projects the following purchases and sales of its product for the next 4 months:  Each unit costs $100, and all purchases are on account. Two-thirds of purchases are paid in the month of the purchase and one-third are paid in the month following the purchase. Bynsel gets a 3% discount whenever it pays in the month of the purchase. The selling price per unit is $200. Sales are 60% cash and 40% on customer credit cards. The bank charges Bynsel a 5% fee for each credit card transaction and transfers the funds to Bynsel's checking account on the same day as the credit card sale.

Each unit costs $100, and all purchases are on account. Two-thirds of purchases are paid in the month of the purchase and one-third are paid in the month following the purchase. Bynsel gets a 3% discount whenever it pays in the month of the purchase. The selling price per unit is $200. Sales are 60% cash and 40% on customer credit cards. The bank charges Bynsel a 5% fee for each credit card transaction and transfers the funds to Bynsel's checking account on the same day as the credit card sale.

-What are cash disbursements for the third month?

Definitions:

Affordable Housing

housing units that are reasonably priced and accessible to individuals and families with moderate to low incomes.

Coalition

A temporary alliance or partnering of groups in order to achieve a common purpose or to engage in joint activity.

Low-income Residents

Individuals or families living with earnings that fall below a designated threshold, often leading to financial insecurity.

Framework

A fundamental structure used as a guide to build, analyze, or understand something complex.

Q7: Target costing is a technique to improve

Q9: Assume that conversion costs are $122,100 for

Q11: When does kaizen costing typically occur?<br>A) Before

Q17: How much of the total activity costs

Q67: Different joint cost allocation methods cause products

Q79: Which of the following is based on

Q91: The direct labor price variance was<br>A) $2,000

Q98: When separable costs are deducted from the

Q101: Cost accounting systems were originally developed to<br>A)

Q118: Advantages of using budgeted values to calculate