Use the following information for the next 8 questions.

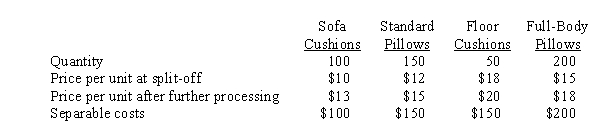

HGT Corporation produces four products from a common production process. Selected data from HGT's accounting system for the four products appears below:  Joint costs for the accounting period totaled $5,000. Each product line has a different product manager, who is evaluated based on product line profitability. Therefore, each manager is motivated to reduce his / her total product line costs as much as possible. The managers have been given information about potential joint cost allocations using the following three methods: physical output, sales at split-off point, and net realizable value. The managers are comparing the joint cost allocations under each method so that they can give the accountant input about their preferred method(s) .

Joint costs for the accounting period totaled $5,000. Each product line has a different product manager, who is evaluated based on product line profitability. Therefore, each manager is motivated to reduce his / her total product line costs as much as possible. The managers have been given information about potential joint cost allocations using the following three methods: physical output, sales at split-off point, and net realizable value. The managers are comparing the joint cost allocations under each method so that they can give the accountant input about their preferred method(s) .

-If HGT allocates joint costs using the physical output method, the total joint cost allocated to standard pillows will be

Definitions:

Distribution

The process of allocating assets, earnings, or dividends among shareholders, or the spread of investments within a portfolio.

Corporate Dividend Payout

The portion of earnings distributed to shareholders in the form of dividends.

Firm's Earnings

The profit of a company after all expenses and taxes have been deducted from revenue, indicating the company’s financial performance over a specified period.

Ex-Dividend Date

The specific date on which a declared dividend is set, after which a stock buyer is not entitled to the declared dividend.

Q12: Which departments in an organization provide services

Q20: When using weighted average process costing<br>A) The

Q25: The principles of activity-based costing can be

Q27: The cost of implementing an ABC system

Q36: Direct materials are allocated I. Very often

Q75: Product design, product production, and customer service

Q104: All of the following are likely to

Q106: Suppose that a company adds material at

Q114: ABC provides more accurate product costs than

Q129: Joint costs are always incurred before the