Use the following information for the next 8 questions.

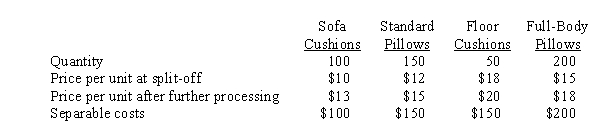

HGT Corporation produces four products from a common production process. Selected data from HGT's accounting system for the four products appears below:  Joint costs for the accounting period totaled $5,000. Each product line has a different product manager, who is evaluated based on product line profitability. Therefore, each manager is motivated to reduce his / her total product line costs as much as possible. The managers have been given information about potential joint cost allocations using the following three methods: physical output, sales at split-off point, and net realizable value. The managers are comparing the joint cost allocations under each method so that they can give the accountant input about their preferred method(s) .

Joint costs for the accounting period totaled $5,000. Each product line has a different product manager, who is evaluated based on product line profitability. Therefore, each manager is motivated to reduce his / her total product line costs as much as possible. The managers have been given information about potential joint cost allocations using the following three methods: physical output, sales at split-off point, and net realizable value. The managers are comparing the joint cost allocations under each method so that they can give the accountant input about their preferred method(s) .

-Assume HGT allocates joint costs using the net realizable value method. Which of the following correctly orders the four product lines from greatest allocation to least allocation?

Definitions:

Antibody

Protein produced in response to the presence of an antigen; each antibody combines with a specific antigen.

Antigen

A substance that stimulates an immune response, especially the production of antibodies, because it is recognized by the body as foreign.

Variable Region

A region in an antibody's structure that varies among different antibodies, allowing them to bind to a vast array of antigens.

Adaptive Immunity

Type of immunity that is characterized by the response of lymphocytes to specific antigens.

Q7: Managers can calculate costs per equivalent unit

Q16: The step-down method does not recognize services

Q29: The best allocation base choice for an

Q57: WST Corporation uses actual amounts to calculate

Q62: (CMA) If Ithica Manufacturing uses the reciprocal

Q65: Activity-based management can be used to manage

Q67: When managers intentionally set budgeted costs too

Q86: If J-M sells products at the split-off

Q97: The practice of using only one base

Q101: Variance analysis can be used for both