Use the following information for the next 8 questions.

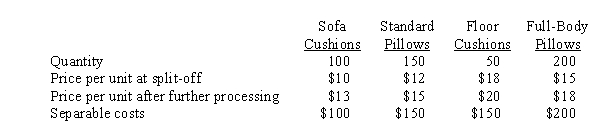

HGT Corporation produces four products from a common production process. Selected data from HGT's accounting system for the four products appears below:  Joint costs for the accounting period totaled $5,000. Each product line has a different product manager, who is evaluated based on product line profitability. Therefore, each manager is motivated to reduce his / her total product line costs as much as possible. The managers have been given information about potential joint cost allocations using the following three methods: physical output, sales at split-off point, and net realizable value. The managers are comparing the joint cost allocations under each method so that they can give the accountant input about their preferred method(s) .

Joint costs for the accounting period totaled $5,000. Each product line has a different product manager, who is evaluated based on product line profitability. Therefore, each manager is motivated to reduce his / her total product line costs as much as possible. The managers have been given information about potential joint cost allocations using the following three methods: physical output, sales at split-off point, and net realizable value. The managers are comparing the joint cost allocations under each method so that they can give the accountant input about their preferred method(s) .

-Joint cost allocations are inappropriate when I. Deciding whether to process a product beyond the split-off point

II. Preparing external financial reports

III. Evaluating the performance of individual project managers

Definitions:

Guidelines

Recommended practices or directives designed to steer actions or decisions in specific situations.

Convey

To communicate or make known information, ideas, or feelings.

Visual

Pertaining to sight or vision, or presented in a form that can be seen or perceived with the eyes.

Tell, Show, Tell Rule

A communication technique where information is first stated, then demonstrated or illustrated, and finally reiterated to enhance understanding.

Q13: What is the per-unit joint cost allocated

Q28: Using a discount rate of 12%, a

Q32: Allen Corporation has the following equity structure:

Q38: If product costs plus allocated support costs

Q40: (Appendix 12A) Which of the following NPV

Q57: Conversion costs may be separated into direct

Q71: Uncontrollable external factors can create challenges in

Q76: When managers use dual-rate allocation, they frequently

Q98: The variable overhead spending variance was<br>A) $10,000

Q129: ABC can be used to determine the