Use the following information for the next 5 questions.

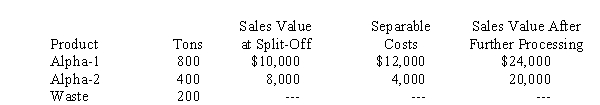

Jordan, Inc. produces 2 products from a joint process costing $24,000. The results from the most recent period follow:

-If Jordan uses the sales value at split-off point method, the joint costs allocated to Alpha-2 would be

Definitions:

Withholding Allowance

A claim made by an employee on a form W-4 to determine the amount of income tax withheld from their paycheck.

Federal Income Tax

A charge imposed by the IRS on the yearly income of persons, corporations, trusts, and various legal bodies.

Gross Earnings

The total amount of money earned by an individual or company before deductions such as taxes and retirement contributions.

Withholding Allowance

A claim made by an employee on the W-4 form that reduces the amount of tax withheld from their paycheck.

Q15: Abnormal spoilage is<br>A) The units that exceed

Q17: Assume that ending work in process is

Q38: Phoxco would like to automate its calligraphy

Q42: Which of the following is the most

Q50: The variable overhead spending variance was<br>A) $1,200

Q60: The direct materials price variance is often

Q74: Using the reciprocal method, the total costs

Q79: Which of the following is not a

Q89: The unit cost assigned to the good

Q103: If Jordan uses the net realizable value