Use the following information for the next 8 questions.

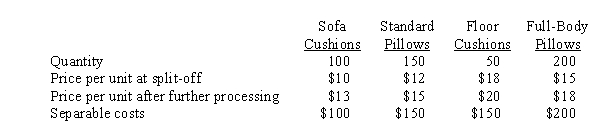

HGT Corporation produces four products from a common production process. Selected data from HGT's accounting system for the four products appears below:  Joint costs for the accounting period totaled $5,000. Each product line has a different product manager, who is evaluated based on product line profitability. Therefore, each manager is motivated to reduce his / her total product line costs as much as possible. The managers have been given information about potential joint cost allocations using the following three methods: physical output, sales at split-off point, and net realizable value. The managers are comparing the joint cost allocations under each method so that they can give the accountant input about their preferred method(s) .

Joint costs for the accounting period totaled $5,000. Each product line has a different product manager, who is evaluated based on product line profitability. Therefore, each manager is motivated to reduce his / her total product line costs as much as possible. The managers have been given information about potential joint cost allocations using the following three methods: physical output, sales at split-off point, and net realizable value. The managers are comparing the joint cost allocations under each method so that they can give the accountant input about their preferred method(s) .

-Which product line would receive the least amount of joint cost under the net realizable value method?

Definitions:

Clayton Act

A U.S. antitrust law, enacted in 1914, aimed at preventing anticompetitive practices in their incipiency and protecting trade and commerce against unlawful restraint and monopoly.

Antitrust Violations

Activities that reduce or prevent competition, deemed illegal under antitrust laws designed to promote fair competition.

Sherman Act

A landmark federal statute in the field of United States antitrust law passed by Congress in 1890 to preserve free and unfettered competition as the rule of trade.

American Tobacco

A historical company involved in the manufacturing and selling of tobacco products, once a major player in the tobacco industry.

Q3: What is ending finished goods inventory for

Q22: ABC systems differ from traditional systems in

Q25: Similar to other costing systems that include

Q31: Static budgets I. Are based on specific

Q89: Activity-based management relies on<br>A) Accurate ABC information<br>B)

Q91: Which of the following statements is true?<br>A)

Q119: Costs incurred beyond the split-off point that

Q119: The cost of purchases for direct material

Q125: If J-M uses the physical output method

Q147: Direct labor costs for 20x1 are<br>A) $312,000<br>B)