Use the following information for the next 8 questions.

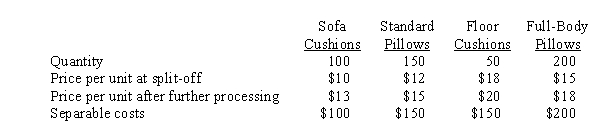

HGT Corporation produces four products from a common production process. Selected data from HGT's accounting system for the four products appears below:  Joint costs for the accounting period totaled $5,000. Each product line has a different product manager, who is evaluated based on product line profitability. Therefore, each manager is motivated to reduce his / her total product line costs as much as possible. The managers have been given information about potential joint cost allocations using the following three methods: physical output, sales at split-off point, and net realizable value. The managers are comparing the joint cost allocations under each method so that they can give the accountant input about their preferred method(s) .

Joint costs for the accounting period totaled $5,000. Each product line has a different product manager, who is evaluated based on product line profitability. Therefore, each manager is motivated to reduce his / her total product line costs as much as possible. The managers have been given information about potential joint cost allocations using the following three methods: physical output, sales at split-off point, and net realizable value. The managers are comparing the joint cost allocations under each method so that they can give the accountant input about their preferred method(s) .

-Assume HGT allocates joint costs using the net realizable value method. Which of the following correctly orders the four product lines from greatest allocation to least allocation?

Definitions:

Agent

An individual or entity authorized to act on behalf of another, known as the principal, in business transactions or other matters.

Liable

Being legally responsible for something, especially in terms of owing compensation or facing legal penalties for wrongful actions.

Subagent

An agent appointed by another agent with the principal's approval, to perform tasks or duties related to the principal's assignment.

Authorization

The formal permission granted by a competent authority to carry out a specific action or process.

Q19: The allocation method that can manipulate the

Q25: The principles of activity-based costing can be

Q25: Similar to other costing systems that include

Q26: When choosing a cost allocation method<br>A) Any

Q86: If the step-down method is used, and

Q90: Equivalent whole units of production<br>A) Are the

Q93: The cost of disposing of an old

Q107: Single-rate allocation methods use only one cost

Q107: In an activity-based budgeting system, managers develop

Q121: One of the primary differences between actual