Use the following information for the next 4 questions.

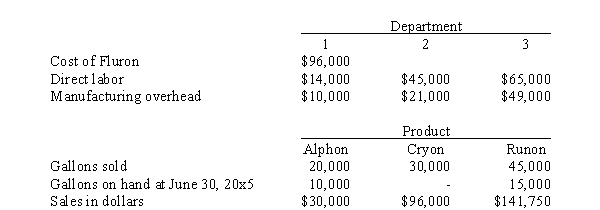

(CPA) Johnson Manufacturing Company buys Fluron for $0.80 per gallon. At the end of processing in Department 1, Fluron splits off into products Alphon, Cryon, and Runon. Alphon is sold at the split-off point, with no further processing. Cryon and Runon require further processing before they can be sold; Cryon is processed in Department 2 and Runon is processed in Department 3. Following is a summary of costs and other related data for the year ended June 30, 20x5.  There were no inventories on hand at July 1, 20x4, and there was no Fluron on hand at June 30, 20x5. All gallons on hand at June 30, 20x5 were complete as to processing. Johnson uses the net realizable value method of allocating joint costs.

There were no inventories on hand at July 1, 20x4, and there was no Fluron on hand at June 30, 20x5. All gallons on hand at June 30, 20x5 were complete as to processing. Johnson uses the net realizable value method of allocating joint costs.

-For allocating joint costs, the net realizable value of Alphon for the year ended June 30, 20x5 would be

Definitions:

Sea of Japan

A marginal sea between the Japanese archipelago, Sakhalin, the Korean Peninsula, and Russia, known for its rich marine biodiversity.

Back-arc Spreading

A process associated with subduction zones where a new ocean basin opens up behind a volcanic arc, often resulting in the formation of new crust.

Gulf of California

A body of water that separates the Baja California Peninsula from mainland Mexico, known for its deep waters and marine biodiversity.

Sea of Japan

A marginal sea between Japan, Russia, and Korea, connected to the Pacific Ocean, notable for its depth and aquatic biodiversity.

Q12: In a job costing system, costs are

Q30: What feature differentiates Kaizen budgeting from other

Q46: If J-M uses the sales value at

Q54: The cost categories that are measured and

Q78: The unit cost assigned to the ending

Q85: Replacing cost-based reimbursement contracts with fixed fee

Q95: In an ABC system, an activity is

Q98: A costing system that charges jobs with

Q102: Which of the following is a simple

Q108: Using the weighted average method, the total