Use the following information for the next 4 questions.

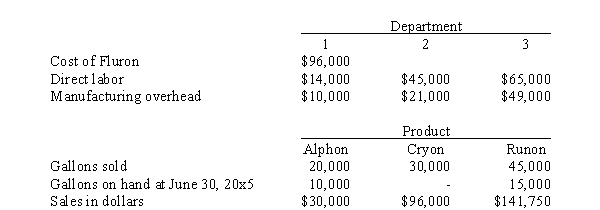

(CPA) Johnson Manufacturing Company buys Fluron for $0.80 per gallon. At the end of processing in Department 1, Fluron splits off into products Alphon, Cryon, and Runon. Alphon is sold at the split-off point, with no further processing. Cryon and Runon require further processing before they can be sold; Cryon is processed in Department 2 and Runon is processed in Department 3. Following is a summary of costs and other related data for the year ended June 30, 20x5.  There were no inventories on hand at July 1, 20x4, and there was no Fluron on hand at June 30, 20x5. All gallons on hand at June 30, 20x5 were complete as to processing. Johnson uses the net realizable value method of allocating joint costs.

There were no inventories on hand at July 1, 20x4, and there was no Fluron on hand at June 30, 20x5. All gallons on hand at June 30, 20x5 were complete as to processing. Johnson uses the net realizable value method of allocating joint costs.

-The joint costs for the year ended June 30, 20x5, to be allocated are

Definitions:

Future Performance

Predictions or expectations regarding a company or investment's actions, achievements, or financial results in upcoming periods.

Risk

The potential for losing something of value, weighed against the potential to gain something of value, often considered in financial investments and business ventures.

Current Financial Position

An individual's or entity's financial status at a particular point in time, considering assets, liabilities, and net worth.

Internal Users

Individuals within an organization, such as managers and employees, who use financial information to make decisions.

Q25: If HGT allocates joint costs using the

Q46: The Phillips Company's budgeted annual indirect labor

Q104: The value of a by-product can be

Q110: (Appendix 11A) The contribution margin sales quantity

Q115: The split-off point is<br>A) The point at

Q116: The denominator in an overhead allocation rate

Q116: The primary disadvantage of zero-based budgeting is<br>A)

Q117: Lookin' for a Home is an animal

Q134: When will the weighted average and FIFO

Q134: Assuming that all of the beginning inventory