Use the following information for the next 4 questions.

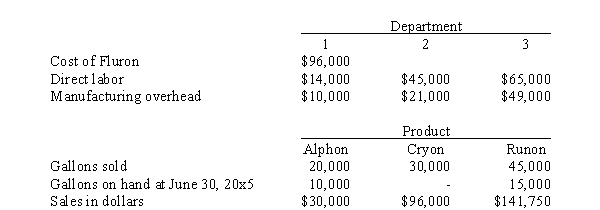

(CPA) Johnson Manufacturing Company buys Fluron for $0.80 per gallon. At the end of processing in Department 1, Fluron splits off into products Alphon, Cryon, and Runon. Alphon is sold at the split-off point, with no further processing. Cryon and Runon require further processing before they can be sold; Cryon is processed in Department 2 and Runon is processed in Department 3. Following is a summary of costs and other related data for the year ended June 30, 20x5.  There were no inventories on hand at July 1, 20x4, and there was no Fluron on hand at June 30, 20x5. All gallons on hand at June 30, 20x5 were complete as to processing. Johnson uses the net realizable value method of allocating joint costs.

There were no inventories on hand at July 1, 20x4, and there was no Fluron on hand at June 30, 20x5. All gallons on hand at June 30, 20x5 were complete as to processing. Johnson uses the net realizable value method of allocating joint costs.

-The cost of Cryon sold for the year ended June 30, 20x5, is

Definitions:

Proportional

Having a constant relation in degree or number between two or more variables.

Regressive

Describing taxes or policies that take a larger percentage from low-income earners than from high-income earners.

Progressive Structure

A tax system where the tax rate increases as the taxable base amount increases, often applied to income tax.

Income-tax System

A government system for assessing and collecting taxes on the income of individuals and businesses.

Q13: What is the per-unit joint cost allocated

Q16: Activity based budgeting<br>A) Is the same as

Q31: The cost of abnormal spoilage is<br>A) $800<br>B)

Q46: If J-M uses the sales value at

Q60: Ideally, activity costs are allocated to cost

Q80: Rewarding employees in one production department for

Q83: In a process costing system with multiple

Q113: The allocation method that allocates fixed and

Q118: Advantages of using budgeted values to calculate

Q128: A flexible budget reflects a range of