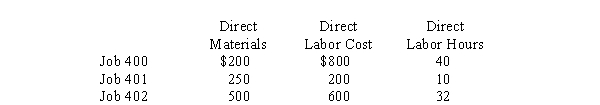

Use the following information for the next 2 questions.  O'Hare Sisters Manufacturing uses job costing and applies overhead using a normal costing system using direct labor hours as the allocation base. This period's estimated overhead cost is $400,000, estimated direct labor cost is $500,000 and estimated direct labor hours are 25,000. This period actual overhead cost was $420,000, actual direct labor cost was $390,000, and actual direct labor hours were 20,000.

O'Hare Sisters Manufacturing uses job costing and applies overhead using a normal costing system using direct labor hours as the allocation base. This period's estimated overhead cost is $400,000, estimated direct labor cost is $500,000 and estimated direct labor hours are 25,000. This period actual overhead cost was $420,000, actual direct labor cost was $390,000, and actual direct labor hours were 20,000.

-What is the total manufacturing cost of Job 400?

Definitions:

Deferred Tax Liability

A tax obligation that arises from temporary differences between the book value and tax value of assets and liabilities, to be paid in the future.

Accumulated Depreciation

The total amount of a tangible asset's cost that has been allocated as depreciation expense over the asset's useful life.

Tax Rate

The percentage at which an individual or corporation is taxed by the government.

Tax Purposes

Refers to the reasons or contexts in which financial and operational information is gathered and analyzed to comply with tax laws and regulations.

Q7: Under the dual-rate method, what amount of

Q34: Assume the step-down method is used. The

Q63: Each cost pool in an ABC system

Q64: The reciprocal method reflects only part of

Q66: Which of the following often prevents managers

Q66: A limiting assumption in CVP analysis is

Q72: The process for making management decisions<br>A) Is

Q90: Typical support departments include accounting and human

Q90: If J-M uses the physical output method

Q119: The simplest cost allocation method is the<br>A)