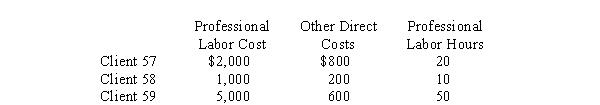

Use the following information for the next 2 questions.  Allen's Accounting Services uses job costing and applies overhead using a normal costing system using professional labor hours as the allocation base. This period's estimated overhead cost is $400,000, estimated professional labor cost is $800,000 and estimated direct labor hours are 8,000. This period actual overhead cost was $426,400, actual direct labor cost was $820,000, and actual direct labor hours were 8,200.

Allen's Accounting Services uses job costing and applies overhead using a normal costing system using professional labor hours as the allocation base. This period's estimated overhead cost is $400,000, estimated professional labor cost is $800,000 and estimated direct labor hours are 8,000. This period actual overhead cost was $426,400, actual direct labor cost was $820,000, and actual direct labor hours were 8,200.

-What is the overhead allocation rate?

Definitions:

Backbone

In networking, a backbone refers to the principal data routes between large, strategically interconnected networks and core routers on the Internet.

Cloud

Computing services delivered over the internet, allowing for resource sharing, storage, and access to software and applications.

Internet

A global network of computers and servers that supports the vast majority of communication and data exchange across the world.

A social networking site that allows users to create profiles, share photos and videos, send messages, and keep in touch with friends, family and colleagues.

Q27: The cost of the ending work in

Q33: Which of the following statements is false?<br>A)

Q60: Assume the full cost of Job #392

Q60: Managers analyze production activities and assign costs

Q62: In general, the risk of measurement error

Q66: A limiting assumption in CVP analysis is

Q69: In CVP analysis, costs are assumed to

Q74: For companies with multiple products, the sales

Q93: ABC systems measure resource flows in an

Q103: Using the FIFO method, the equivalent unit