Use the following information for the next 3 questions.

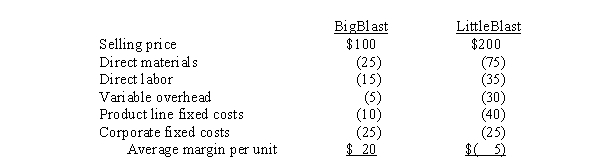

Horton and Associates produces two products named BigBlast and LittleBlast. Last month 4,000 units of BigBlast and 1,000 units of the LittleBlast were produced and sold. Following are average prices and costs for last month:  The production lines for both products are highly automated, so large changes in production cause very little change in total direct labor costs. Workers who are classified as direct labor monitor the production line and are permanent employees who regularly work 40 hours per week. All costs other than "corporate fixed costs" listed under each product line could be avoided if the product line were dropped.

The production lines for both products are highly automated, so large changes in production cause very little change in total direct labor costs. Workers who are classified as direct labor monitor the production line and are permanent employees who regularly work 40 hours per week. All costs other than "corporate fixed costs" listed under each product line could be avoided if the product line were dropped.

-What is the breakeven sales volume (in units) for BigBlast? (In other words, what is the sales volume at which Horton should be financially indifferent between dropping and keeping BigBlast?)

Definitions:

Raw Materials

Basic materials from which products are made, typically unprocessed or only minimally processed states of resources used in production.

Component Parts

Individual pieces or elements that are assembled to form a finished product.

Production Goods

Products and materials that are used in the manufacturing process to produce the final goods for consumption or sale.

Accessory Equipment

Supplementary components or items that enhance or complete the functionality of a main product or system.

Q23: Incentive trips have the following features except

Q40: Each year Wright's Widgets buys 10,000 subcomponents

Q54: Generally speaking, activity-based costing traces direct costs

Q55: Compared to a traditional costing system, an

Q74: For companies with multiple products, the sales

Q79: Which of the following is not true

Q79: In a normal costing system, the overhead

Q103: The following qualitative factors are relevant to

Q104: Organizational core competencies are the tactics that

Q128: Manufacturers may track scrap to determine whether<br>A)