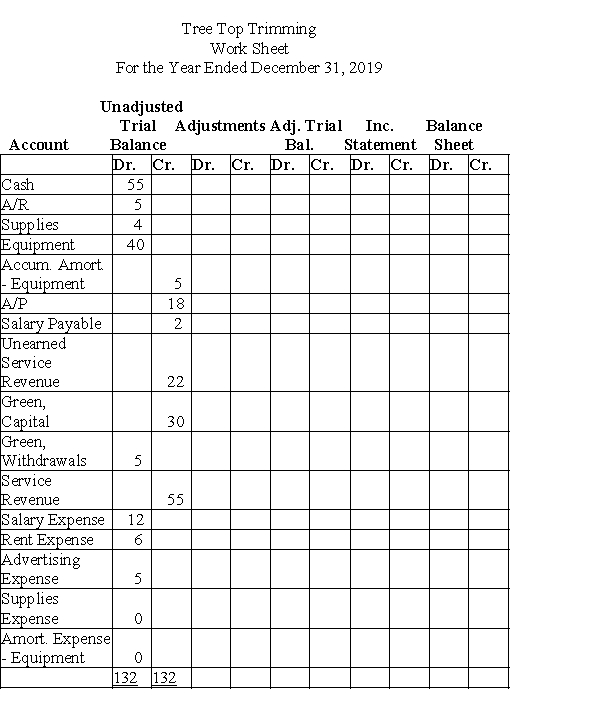

Given the following worksheet with the trial balance already entered, and the adjustment information, complete the worksheet.  Additional information:

Additional information:

a)Accrued Salaries, $10.

b)Supplies used, $2.

c)Balance of unearned service revenue at end of period, $12.

d)Amortization expense, $3.

e)Accrued service revenue, $5.

Definitions:

Respect For The Elderly

The practice of showing honor and consideration to older individuals, recognizing their contributions and wisdom.

Individualism

A thought school in societal studies that places the freedom of the individual as paramount, in contrast to control by the collective or state.

Collectivism

A cultural value that emphasizes the importance of the group over the individual, prioritizing community and social cohesion.

Personal Modesty

A value or behavior that involves humility, avoiding excess, and maintaining privacy, especially regarding personal life and appearance.

Q30: Which of the following are all temporary

Q31: The balance in prepaid rent after adjustment

Q32: In a periodic inventory system, the entry

Q46: In the double-entry accounting system, each transaction:<br>A)involves

Q59: Which of the following statements is false?<br>A)A

Q75: Prepare a balance sheet dated December 31,

Q109: Net income is reported on the income

Q124: Unearned revenue shows a beginning balance of

Q147: Sales revenue minus sales returns and allowances

Q160: An advertising bill received in the current