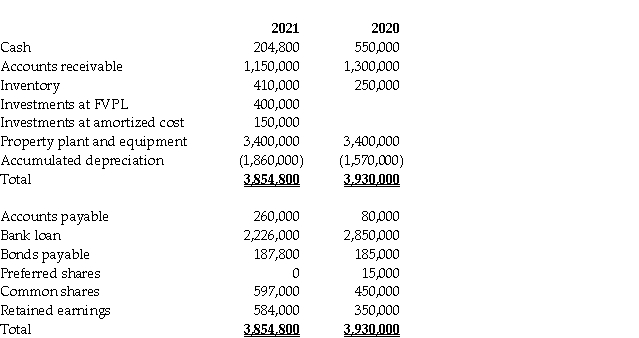

Financial information for Fesone Inc.'s balance sheet for fiscal 2020 and 2021 follows:  Additional information:

Additional information:

1. Preferred shares were converted to common shares during the year at their book value.

2. The face value of the bonds is $200,000; they pay a coupon rate of 6% per annum. The effective interest rate of interest is 8% per annum.

3. Net income was $290,000.

4. There was an ordinary stock dividend valued at $12,000 and cash dividends were also paid.

5. Interest expense for the year was $130,000. Income tax expense was $116,000.

6. Fesone arranged for a $200,000 bank loan to finance the purchase of the investment at amortized cost.

7. Fesone has adopted a policy of reporting cash flows arising from the payment of interest and dividends as operating and financing activities, respectively.

8. The investment at FVPL is held for trading purposes.

Required:

a. Prepare a statement of cash flows for the year ended December 31, 2021 using the indirect method.

b. Discuss how the transaction(s)above that are not reported on the statement of cash flows are reported in the financial statements.

Definitions:

Collectivist Cultures

Societies that prioritize the needs and goals of the group over individual desires or ambitions.

Individualistic Cultures

Societies that emphasize personal achievements and rights, encouraging individuals to pursue their goals and self-expression.

Realistic Conflict Theory

A social psychology theory that suggests conflicts between groups are caused by direct competition for limited resources.

Stereotypes

Overgeneralized beliefs about a particular category of people, assuming that all members of the category share the same characteristics.

Q22: For the following lease, determine the

Q29: O'Neil Manufacturing issued 200,000 stock options to

Q45: Which statement is correct about diluted EPS?<br>A)The

Q47: What is the "ex-dividend" date for the

Q61: The adjusted trial balance includes all accounts

Q61: A company has income before tax of

Q70: What are three potential outcomes for defaults

Q74: Describe the options available for reporting investments

Q134: Which of the following financial statements uses

Q139: Determine the expenses for the current