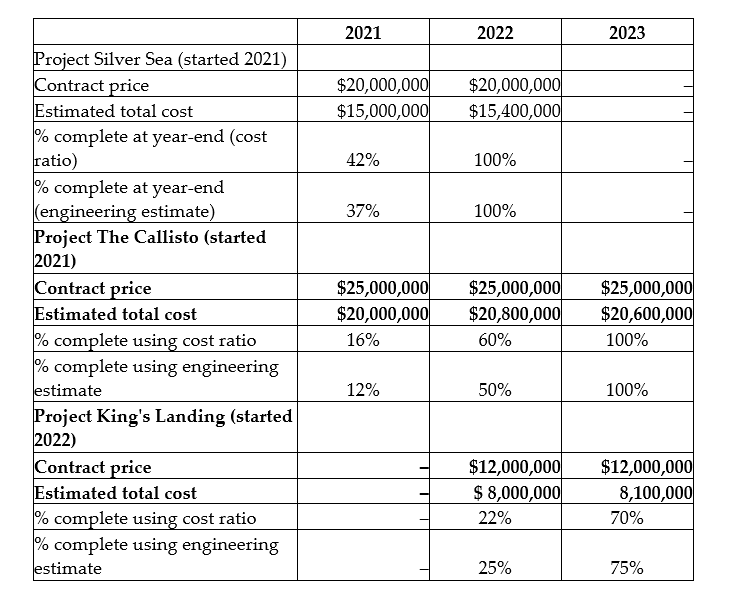

Sawatsky & Company Ltd is involved in the construction of top class luxury condos in Vancouver, Canada. Until the end of 2022, the company used the cost ratio method to estimate the percentage complete. After that point, the company switched to using estimates from architectural engineers to estimate the degree of completion. To prepare the financial report for the 2023 fiscal year, you have gathered the following data on projects that were in progress at the end of fiscal years 2021, 2022, and 2023:

Required:

a. Compute the amount of revenue and cost of sales that was recognized in 2021 and 2022 using the old accounting policy.

b. Compute the amount of revenue and cost of sales that should be recognized in each year using the new accounting policy.

c. Record the adjusting journal entries to adjust revenue to reflect the change in accounting policy from using the cost ratio to using engineering estimates. The general ledger accounts for 2023 have not yet been closed. Ignore income tax effects.

Definitions:

Q5: The financial statements should be prepared in

Q8: Why are "cash and cash equivalents" treated

Q21: List four factors that preclude the seller-lessee

Q22: Which statement is correct?<br>A)A deductible temporary difference

Q25: LMN Company reported the following amounts on

Q27: What is an actuarial loss?<br>A)An unfavourable difference

Q64: An owner investment of office furniture into

Q84: O'Neil Motor Parts issued 110,000 stock options

Q139: Determine the expenses for the current

Q157: What classifications of Canadian corporations are required