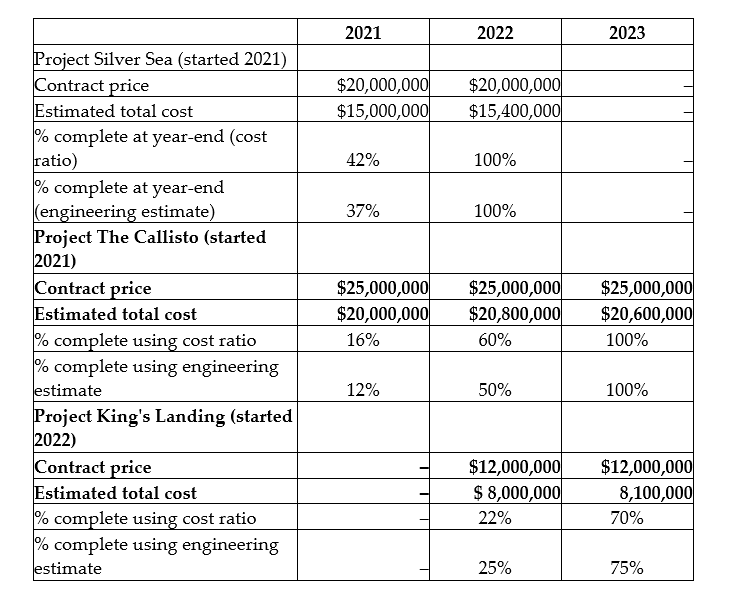

Sawatsky & Company Ltd is involved in the construction of top class luxury condos in Vancouver, Canada. Until the end of 2022, the company used the cost ratio method to estimate the percentage complete. After that point, the company switched to using estimates from architectural engineers to estimate the degree of completion. To prepare the financial report for the 2023 fiscal year, you have gathered the following data on projects that were in progress at the end of fiscal years 2021, 2022, and 2023:

Required:

a. Compute the amount of revenue and cost of sales that was recognized in 2021 and 2022 using the old accounting policy.

b. Compute the amount of revenue and cost of sales that should be recognized in each year using the new accounting policy.

c. Record the adjusting journal entries to adjust revenue to reflect the change in accounting policy from using the cost ratio to using engineering estimates. The general ledger accounts for 2023 have not yet been closed. Ignore income tax effects.

Definitions:

Trade

The exchange of goods, services, or both between parties, which can occur domestically or internationally.

World Price

World Price is the international price of a good, determined by global supply and demand, affecting domestic markets.

Domestic Market

The availability and need for products and services inside the boundaries of a nation.

Surplus

A situation where the quantity of a product or resource exceeds the quantity demanded or utilized.

Q4: What is speculation?

Q14: Rules of professional conduct for accountants should:<br>A)be

Q17: Calculate the incremental EPS for the following

Q26: Which is a correct statement?<br>A)The direct method

Q28: A retailer increases bad debts expense from

Q61: Public corporations must follow IFRS when preparing

Q63: What is a "future"?<br>A)A contract in which

Q83: When will bonds sell at a discount?<br>A)When

Q85: An owner investment of land valued at

Q93: Incurring an expense in the current accounting