SCENARIO 9-1

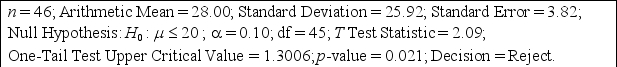

Microsoft Excel was used on a set of data involving the number of defective items found in a random sample of 46 cases of light bulbs produced during a morning shift at a plant.A manager wants to know if the mean number of defective bulbs per case is greater than 20 during the morning shift.She will make her decision using a test with a level of significance of 0.10.The following information was extracted from the Microsoft Excel output for the sample of 46 cases:

-Referring to Scenario 9-1,the null hypothesis would be rejected if a 1% probability of committing a Type I error is allowed.

Definitions:

Contribution Margin

The amount remaining from sales revenue after variable costs have been deducted, indicating how much revenue is contributing to covering fixed costs and generating profit.

Income Statement

A financial statement that reports a company's financial performance over a specific accounting period, detailing revenues and expenses.

Expenses

Outflows or depletions of assets or incurrences of liabilities during a period as a result of delivering or producing goods, rendering services, or carrying out other activities linked to an entity's main operations.

Variable Costing

A costing method where variable manufacturing costs are treated as product costs, and fixed manufacturing overhead is treated as a period cost.

Q36: An unbiased estimator will have a value,

Q52: In what type of test is the

Q85: Referring to Scenario 8-5, 95% of all

Q91: You were told that the mean score

Q101: Referring to Scenario 6-2, John's income as

Q104: Referring to Scenario 7-3, what is the

Q108: Referring to Scenario 10-11, construct a 95%

Q115: The marketing manager for an automobile manufacturer

Q154: Referring to Scenario 10-10, what is/are

Q176: Referring to Scenario 10-12, the same decision