SCENARIO 12-11

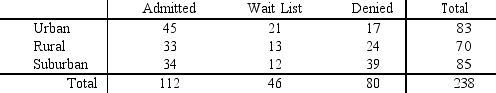

The director of admissions at a state college is interested in seeing if admissions status (admitted,waiting list,denied admission)at his college is independent of the type of community in which an applicant resides.He takes a sample of recent admissions decisions and forms the following table:

He will use this table to do a chi-square test of independence with a level of significance of 0.01.

He will use this table to do a chi-square test of independence with a level of significance of 0.01.

-Referring to Scenario 12-11,the same decision would be made with this test if the level of significance had been 0.05.

Definitions:

Black-Scholes Option Pricing Model

A mathematical formula used to determine the theoretical price of European put and call options, taking into account factors like the stock price, strike price, time to expiration, and volatility.

Strike Price

The set price at which the holder of a financial option has the right to buy (call) or sell (put) the underlying asset.

Market Price

The current price at which an asset or service can be bought or sold in a marketplace.

Strike Price

The predetermined price at which someone holding an option has the right to purchase (if it is a call option) or sell (if it is a put option) the specific asset or commodity.

Q2: Referring to Scenario 12-3, suppose the director

Q34: Referring to SCENARIO 13-17, what is the

Q70: If the correlation coefficient (r) = 1.00,

Q75: Referring to Scenario 12-5, what is the

Q92: Referring to Scenario 12-5, the overall or

Q131: If a categorical independent variable contains 2

Q172: Referring to SCENARIO 13-2, suppose an employee

Q203: Referring to Scenario 12-4, the managers

Q278: Referring to Scenario 10-14, what is the

Q288: Referring to Scenario 10-9, if you want