SCENARIO 12-12

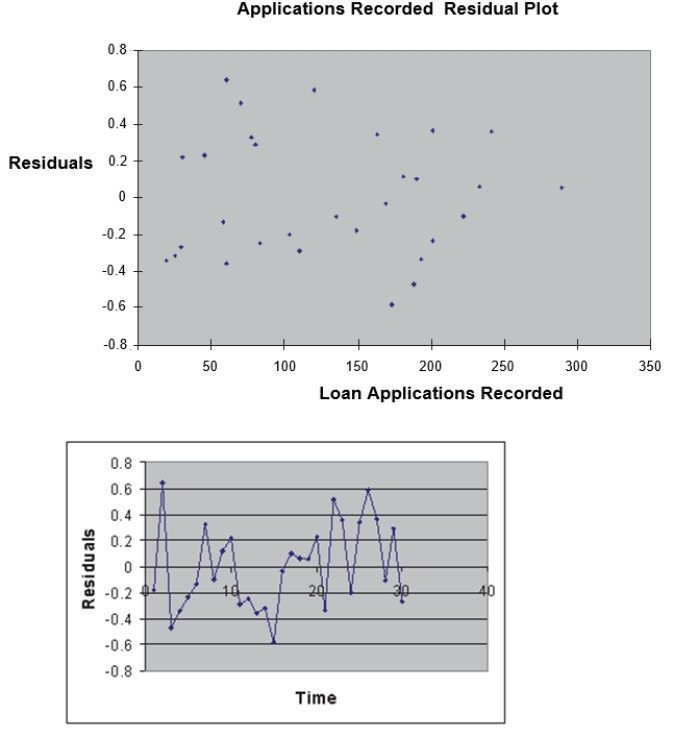

The manager of the purchasing department of a large saving and loan organization would like to develop a model to predict the amount of time (measured in hours) it takes to record a loan

application.Data are collected from a sample of 30 days, and the number of applications recorded and completion time in hours is recorded.Below is the regression output: 12-46 Simple Linear Regression  Simple Linear Regression 12-47

Simple Linear Regression 12-47

-Referring to Scenario 12-12, there is a 95% probability that the mean amount of time needed to record one additional loan application is somewhere between 0.0109 and 0.0143 hours.

Definitions:

Actuarial Information

Data and analysis related to the calculation of insurance risks and premiums, often involving life expectancy, health risks, and financial implications.

Bond Issue

The process by which a company or governmental entity raises funds by selling bonds to investors, which are debt securities obligating the issuer to pay interest and repay principal at a later date.

Effective Interest Method

An accounting technique used to allocate the bond premium or discount over the life of the bond in a way that results in a constant rate of interest.

Interest Expense

Interest expense is the cost incurred by an entity for borrowed funds, typically reported on the income statement within the financing or other expenses section.

Q8: Referring to SCENARIO 13-15, you can

Q8: Referring to Scenario 12-5, the test will

Q31: Referring to Scenario 10-15, what assumptions are

Q49: Referring to Scenario 12-11, the expected cell

Q61: The residual represents the discrepancy between the

Q66: Referring to SCENARIO 13-15, the null

Q82: Referring to Scenario 12-5, the decision made

Q174: Referring to SCENARIO 13-7, the net regression

Q179: The purpose of a control chart is

Q184: Referring to SCENARIO 10-3, using an overall