SCENARIO 14-5

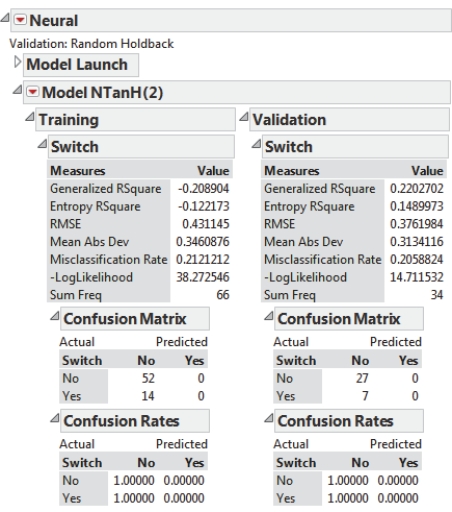

The output below shows the results of the neural network model that has been constructed to predict the probability of a cable company's customers who will switch ("Yes" or "No") into its bundled program offering based on the price ($30, $40, $50, $60) and whether the customer spends more than 5 hours a day watching TV ("Yes" or "No") using the data set of

100 customers collected from a survey.

-Referring to SCENARIO 14-5, out of the 27 customers who did not switch in the validation data set, how many are correctly classified by the neural network?

Definitions:

Risk Aversion

A preference to minimize uncertainty and avoid risk in investment decisions.

Systematic Risk

The inherent risk that affects the entire market or a wide range of securities, often caused by factors like economic, political, or global events, and cannot be mitigated just by diversification.

Beta

Beta is a measure of a stock's volatility in relation to the overall market, indicating the stock's risk compared to that of the market.

Market Portfolio

A theoretical bundle of investments that includes every type of asset available in the market, with each asset weighted according to its total market value.

Q3: A patient is being prepared for a

Q8: A patient is attending counseling to learn

Q11: The nurse is providing care for a

Q12: The nurse is providing care for a

Q13: A patient recovering from electroconvulsive therapy (ECT)

Q15: The nurse notes that a patient with

Q59: The total sum of squares (SST) in

Q60: Referring to Scenario 12-10, what is the

Q134: Referring to SCENARIO 13-15, the null

Q220: Quick Changeover Techniques is among the tools