SCENARIO 2-1

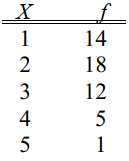

An insurance company evaluates many numerical variables about a person before deciding on an appropriate rate for automobile insurance.A representative from a local insurance agency selected a random sample of insured drivers and recorded,X,the number of claims each made in the last 3 years,with the following results.

-Referring to Scenario 2-1,how many drivers are represented in the sample?

Definitions:

Annual Coupon Rate

A bond's yearly interest payment to its holders, expressed as a percentage of the bond's face value.

Maturity

The specified time at which the principal amount of a bond or loan is due to be paid back to the lender.

Call Premium

The additional amount that must be paid over the par value by the issuer to redeem a callable security before its maturity date.

Default Risk Premium (DRP)

The additional yield that investors demand for holding a bond that has a risk of default over a risk-free bond.

Q16: A patient in shock is diagnosed with

Q21: A personal computer user survey was conducted.Number

Q21: Referring to Scenario 3-6, compute the geometric

Q24: Which descriptive summary measures are resistant statistics?<br>A)The

Q28: Referring to Scenario 1-2, the possible responses

Q29: The nurse is assessing a patient who

Q60: Which of the arithmetic mean, median, mode,

Q112: A statistic is usually unobservable while a

Q195: Referring to Scenario 2-13, construct a percentage

Q212: The larger the number of observations in