SCENARIO 12-12

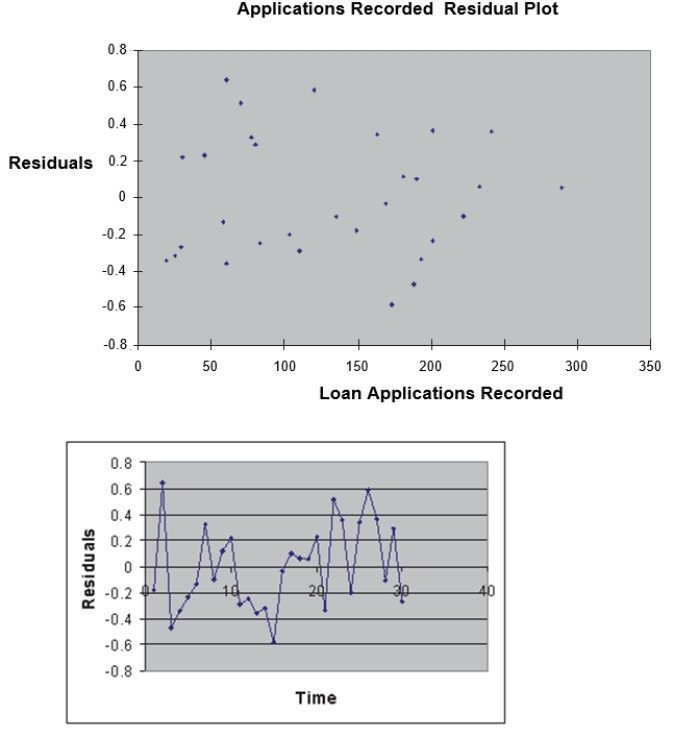

The manager of the purchasing department of a large saving and loan organization would like to develop a model to predict the amount of time (measured in hours) it takes to record a loan

application.Data are collected from a sample of 30 days, and the number of applications recorded and completion time in hours is recorded.Below is the regression output: 12-46 Simple Linear Regression  Simple Linear Regression 12-47

Simple Linear Regression 12-47

-Referring to Scenario 12-12, to test the claim that the mean amount of time depends positively on the number of loan applications recorded against the null hypothesis that the mean amount of time does not depend linearly on the number of invoices processed, the p-value of the test statistic is .

Definitions:

Undiscounted Sum

The total of all future cash flows associated with an investment or project without adjusting them for their present value.

Discounted

The method of calculating the current value of a future sum of money or series of cash flows using a particular return rate.

Interest Expense

The financial charges a company bears for loaned money across a time frame.

Note Payable-National Bank

A written promise to pay a specific sum of money, borrowed from a national bank, at a future date.

Q26: Referring to Scenario 12-12, how many children

Q61: Bullet graphs that use color to represent

Q63: Referring to SCENARIO 15-5, a p control

Q66: Referring to Scenario 12-11, the value of

Q67: Referring to SCENARIO 13-7, the department

Q83: Referring to Scenario 12-7, there is sufficient

Q150: Referring to Scenario 12-10, what is the

Q209: Referring to Scenario 10-15, what is the

Q253: Referring to SCENARIO 10-3, in testing the

Q259: Referring to SCENARIO 13-4, what are the